All Categories

Featured

Table of Contents

[/image][=video]

[/video]

The landscape is moving. As rate of interest prices decline, taken care of annuities might lose some appeal, while items such as fixed-index annuities and RILAs gain grip. If you're in the market for an annuity in 2025, store meticulously, contrast alternatives from the very best annuity firms and focus on simpleness and openness to find the appropriate fit for you.

When choosing an annuity, monetary stamina rankings matter, but they do not tell the entire tale. Below's how compare based on their scores: A.M. Finest: A+ Fitch: A+ Criterion & Poor's: A+ Comdex: A.M. Ideal: A+ Fitch: A+ Moody's: A1 Criterion & Poor's: A+ Comdex: A.M. Finest: A+ Moody's: A1 Requirement & Poor's: A+ Comdex: A greater economic rating or it only mirrors an insurer's financial stamina.

A lower-rated insurance company may offer a, resulting in significantly more income over retirement. If you focus just on scores, you may The finest annuity isn't almost firm ratingsit's around. That's why contrasting real annuity is more crucial than just taking a look at financial stamina ratings. There's a whole lot of sound available when it involves monetary suggestions regarding annuities.

We have years of experience helping individuals find the appropriate items for their needs. And due to the fact that we're not affiliated with any type of company, we can give you honest advice about which annuities or insurance plans are best for you.

We'll help you sort with all the options and make the finest choice for your situation.

, there are several alternatives out there. And with so several selections, recognizing which is right for you can be tough. Go with a highly-rated company with a strong credibility.

Are Annuities Safe From Lawsuits

Select an annuity that is simple to comprehend and has no gimmicks. By following these standards, you can be sure you're getting the very best feasible bargain on a fixed annuity.: Oceanview Annuity since they have a tendency to have greater rate of interest with common liquidity. ("A" rated annuity business): Clear Spring Annuity due to the fact that they are straightforward, strong annuity prices and basic liquidity.

Some SPIAs supply emergency situation liquidity includes that we such as.

There are a couple of crucial aspects when searching for the finest annuity. Contrast rate of interest rates. A higher passion rate will certainly supply more growth capacity for your financial investment.

This can immediately improve your financial investment, but it is vital to recognize the terms and problems affixed to the bonus offer prior to investing. Think regarding whether you want a life time earnings stream. This kind of annuity can provide satisfaction in retirement, however it is vital to guarantee that the income stream will certainly suffice to cover your requirements.

These annuities pay a set monthly quantity for as long as you live. And also if the annuity lacks money, the monthly payments will continue coming from the insurance coverage firm. That implies you can rest easy understanding you'll constantly have a consistent income stream, regardless of the length of time you live.

Can You Roll Over A Fixed Annuity To An Ira

While there are a number of different kinds of annuities, the most effective annuity for long-term care expenses is one that will pay for most, if not all, of the expenses. There are a couple of points to consider when choosing an annuity, such as the length of the agreement and the payment options.

When choosing a set index annuity, contrast the available items to find one that ideal suits your needs. Delight in a lifetime earnings you and your spouse can not outlast, supplying monetary safety and security throughout retired life.

Annuity Insights

In enhancement, they enable up to 10% of your account worth to be taken out without a fine on the majority of their item offerings, which is greater than what most other insurance policy business enable. One more element in our suggestion is that they will certainly enable elders approximately and consisting of age 85, which is also more than what a few other business permit.

The very best annuity for retirement will rely on your individual demands and purposes. Some functions are usual to all suitable retired life annuities. Primarily, an ideal annuity will certainly provide a constant stream of earnings that you can depend on in retirement. It should also use a risk-free investment option with prospective development without threat.

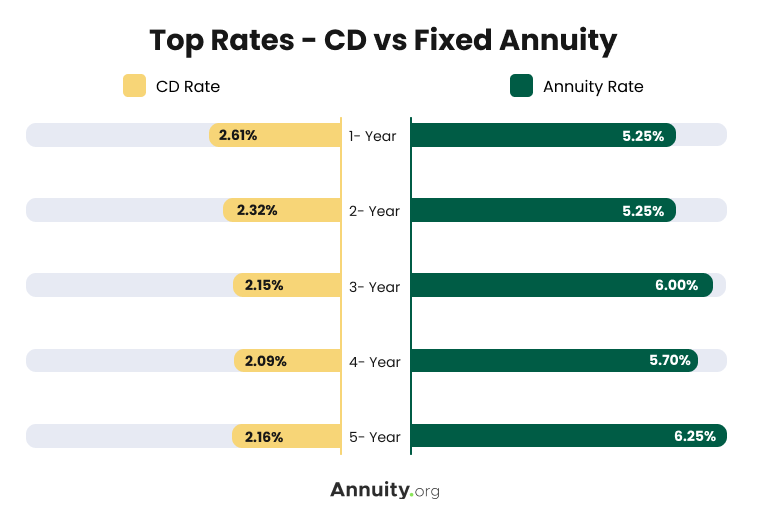

Best Fixed Annuity Rates - March 2025

An ideal annuity needs to additionally give a death benefit so your enjoyed ones are looked after if you die. Our referral is. They are and consistently provide a few of the greatest payments on their retirement income annuities. While prices rise and fall throughout the year, Integrity and Guarantee are generally near the leading and maintain their retired life revenues competitive with the other retired life income annuities in the marketplace.

These ratings provide consumers an idea of an insurer's monetary stability and exactly how likely it is to pay out on claims. It's important to note that these ratings don't necessarily show the top quality of the items supplied by an insurance firm. An "A+"-rated insurance coverage firm can use items with little to no growth possibility or a reduced earnings for life.

After all, your retirement savings are likely to be among one of the most crucial financial investments you will certainly ever make. That's why we only recommend collaborating with an. These companies have a tried and tested track record of success in their claims-paying ability and supply many attributes to assist you meet your retirement goals."B" rated firms should be avoided at nearly all expenses. If the insurance provider can not obtain an A- or much better ranking, you need to not "wager" on its competence long-lasting. Remarkably, numerous insurance policy firms have actually been around for over 50 years and still can not acquire an A- A.M. Best ranking. Do you wish to bet cash on them? If you're seeking lifetime income, adhere to assured income bikers and avoid performance-based revenue riders.

Table of Contents

Latest Posts

What Is A Cash Refund Annuity

Crisis Waiver Annuity

Annuity Calculater

More

Latest Posts

What Is A Cash Refund Annuity

Crisis Waiver Annuity

Annuity Calculater